Second City Utility Bill for 2023 Mailed to UA Households

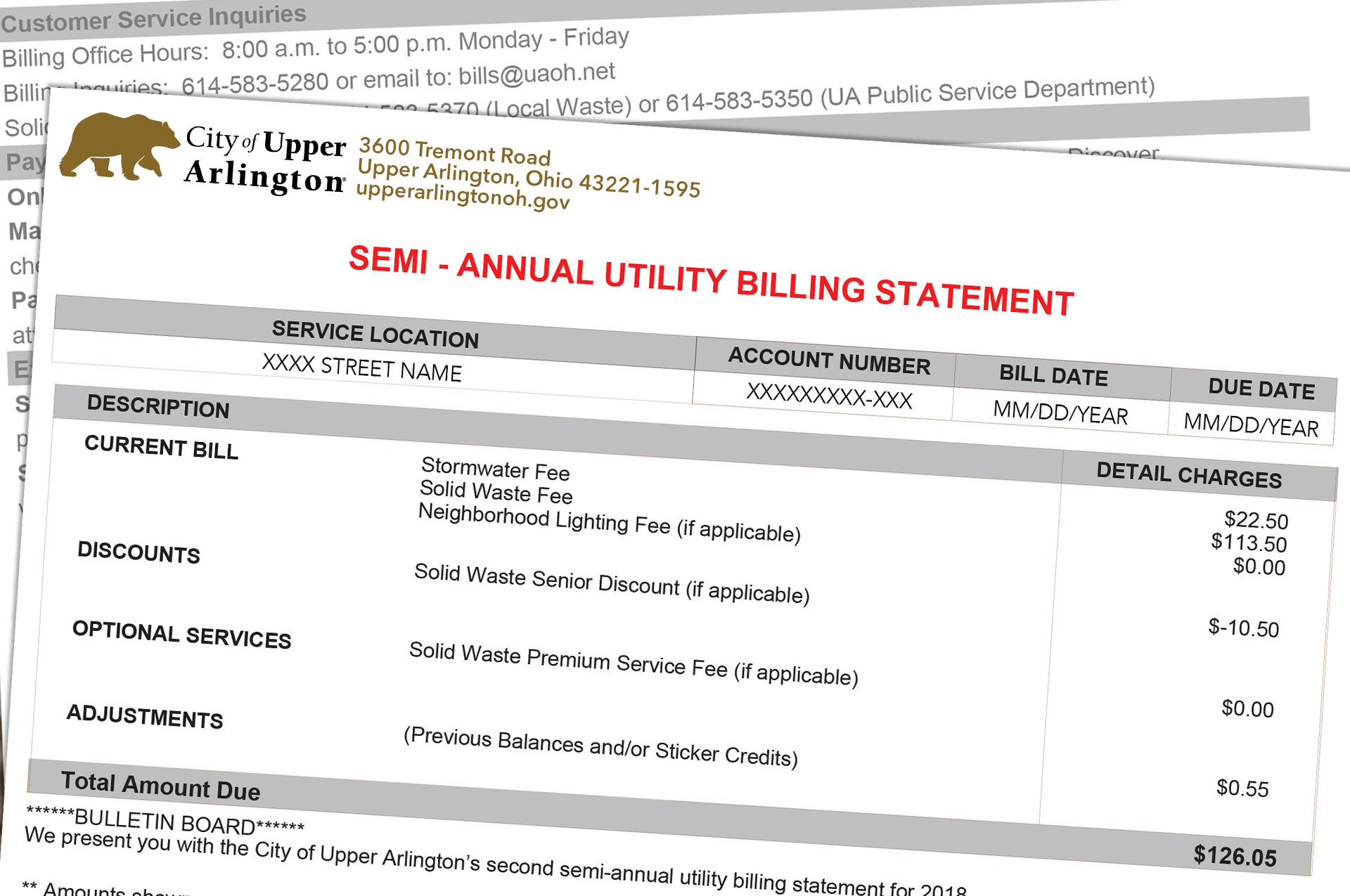

The second of two semi-annual utility invoices from the City for 2023 was recently mailed to UA households. These invoices include the Solid Waste fee, the Stormwater Utility fee, and in some cases a Neighborhood Lighting Utility fee. The deadline for payments is Friday, July 21.

The Stormwater Utility fee helps to defray the costs of our City’s deteriorating storm drainage system.

The Solid Waste Service fees cover the costs for providing trash, recycling, bulk item and yard waste collection services. The standard semi-annual billing amount is $150.25 (including a base fee, community recycling fee and administrative fee).

Some other highlights relative to your Solid Waste service:

- Applications for new Medical Exemptions and Premium Service are accepted on an ongoing basis.

- Premium Service customers may cancel this option at any time.

- Senior Discount – Single-unit homeowners who reside at the address and are aged 60 years or above can qualify for a discount on their Solid Waste base fee at any time by completing an online form. The first discount will not take effect until the next semi-annual bill. Once qualified, there is no need to reapply.

Payment of the Utility Invoice is the responsibility of the property owner(s). Similar to property tax, the fees remain attached to the property. The City will not make refunds or prorated adjustments for a partial year. Consult with your realtor and title/escrow closer for adjusting balances between buyers if necessary. Any discounts remain with the property’s account until a property transfer is recorded with Franklin County. Any discounts or optional services at the time of transfer will be removed from the property’s account due to new ownership.

If you have questions about these fees or your bill, send an email to the Finance Department. Our thanks in advance for your prompt payment.

- Click here to pay your bill online

- Click here to search for your utility bill address

- Click here for Solid Waste pricing details